If you are using Multicurrency in your Beyond Software system, the application of a customer payment on the Cash Application screen results in a “realized” gain/loss – or possibly in a neutral impact (no gain/loss) – financially. In the case of an exact match, no action is taken regarding the creation of a gain/loss journal entry.

When a payment is received and approved in the Cash Processing screen, the System debits (increases) a bank/cash account and credits (decreases) an accounts receivable account. At cash processing approval, all required ledger transactions are generated regarding the payment. In terms of exchange rate and base currency, whether the payment was more or less than the invoice is determined only after the cash application has occurred.

At cash/payment application time, if there was a currency gain (the base currency payment amount is greater than the base currency invoice total), the System credits the Realized Currency Gain account by the amount of the difference. If there was a currency loss (the base currency payment amount is less than the base currency invoice total), the System debits the Realized Currency Loss account.

The realized currency gain/loss journal entry generated at cash application time is posted automatically. The journal entry description uses the invoice number with leading zeros for a total of eight digits and is formatted like in this example: “Currency realized gain/loss for Receivables invoice 99999999”.

To create a balanced, double-entry accounting transaction for the realized gain/loss, the realized currency gain/loss account is one half of the transaction while the accounts receivable account from the cash processing transaction is the other half of the double-entry transaction.

The following tables show gain and loss transaction examples using USD ($) as the base currency and EUR (€) as the transaction currency:

|

Invoice (€) |

Invoice ($) |

Payment (€) |

Payment ($) |

Realized Gain ($) |

|---|---|---|---|---|

|

1,000 |

1,100 |

1,000 |

1,200 |

100 |

|

Invoice (€) |

Invoice ($) |

Payment (€) |

Payment ($) |

Realized Loss ($) |

|---|---|---|---|---|

|

1,000 |

1,100 |

1,000 |

1,000 |

(100) |

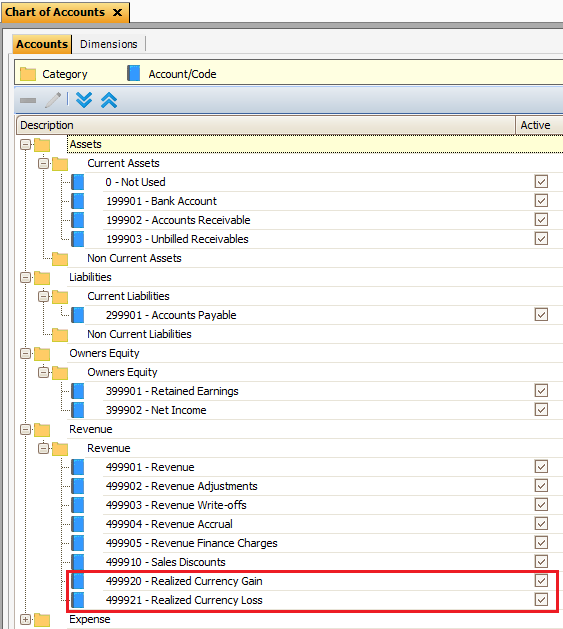

The realized currency gain/loss accounts are income accounts and are defined in the Revenue portion of your chart of accounts. You can use one account for both gains and losses, by currency, or two accounts for all gains and losses as shown here: